Filing a claim against inherited property

At the time of death, a citizen may be a debtor on loans, borrowings, mortgages and other obligations.

Debts can be divided into 2 categories:

- Personal debts.

They are not collected from heirs. From the moment of death of the debtor, they are considered automatically repaid. These are obligations for alimony and fines. Important! Personal debts include only the general alimony obligation. If a citizen has already accumulated debt, it must be repaid from the inherited property. - Property debts. These are loans, credits and other obligations. They pass to the heirs in proportion to their shares in the inherited property.

If a citizen dies without paying the loan or utility debts, the creditor can collect the debt from the heirs. Until they enter into legal rights, a claim may be made against the inherited property.

Since any property cannot be ownerless, the inheritance that was not formalized by the relatives of the deceased passes to the municipality or the state. This is called escheat inheritance (Article 1151 of the Civil Code of the Russian Federation).

Therefore, a claim against the inherited property can only be brought within 6 months from the date of death of the debtor.

Grounds for applying to the probate court

So, if inheritance through a notary's office is impossible, inheritance through the court is allowed. To do this, the heir needs to apply to the court with a statement of claim.

Most of the possible grounds for going to court were described in detail in the article “Entering an inheritance through the court.”

Without going into details, we are talking about the following reasons:

- Actual acceptance of inheritance - the need to recognize ownership of inherited property;

- Recognition of heirs as unworthy;

- Violations by a notary of the procedure for registering inheritance;

- Missing the inheritance period;

- The need to challenge or invalidate a will;

- The need to establish legal facts related to the inheritance case (kinship, shares of spouses in jointly acquired property);

- Disputes about the division of inherited property.

Obviously, the reasons that force you to go to probate court can be very diverse. This results in different contents of the statement of claim and different claims.

When to file a claim against inherited property

You can bring a claim against the estate before the heirs accept the inheritance. After this point, the requirements will have to be presented directly to the heirs (clause 3 of Article 1175 of the Civil Code of the Russian Federation).

Be sure to check the statute of limitations for your claim. If it is coming to an end, we recommend that you do not wait for the inheritance to be accepted and file a claim against the inherited property.

The fact is that, as a general rule, heirs can accept an inheritance within six months after the opening of the inheritance, and under certain circumstances this period may increase (Article 1154 of the Civil Code of the Russian Federation). All this time, the statute of limitations on your claim, which began before the opening of the inheritance, continues to run (clause 59 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9). And if it expires before the heirs accept the inheritance, and you do not file a claim, then most likely you will no longer be able to collect the debt.

If you go to court with a claim against the inherited property, then from the date of filing the statute of limitations will not run (Clause 1 of Article 204 of the Civil Code of the Russian Federation).

Who is the defendant?

In accordance with Art.

1175 of the Civil Code of the Russian Federation, the heir is liable for the debts of the deceased to the extent of the property received. That is, he is not obliged to spend his own money on repaying the debt. If the number of debts exceeds the amount of property, it is not profitable for the heir to accept the property of the testator. After all, during the registration process, he will have to pay the notary’s state fee, property valuation, and also incur other costs.

If the legal successors do not formalize the inheritance, then the property goes to the state.

Creditors can apply for debt collection during the entire limitation period (from the date of the last payment on the debt). Moreover, it is not subject to suspension or restoration.

The period of acceptance of the inheritance (6 months from the date of death) is also counted towards the limitation period. During this period, the creditor can only make claims against the inherited property. Since it does not yet have an official owner.

Important! The law does not establish a defendant in a claim against the estate.

Liability of the heir for the debts of the testator

Are debts and loans of parents inherited by children?

Debt collection from the heirs of the deceased

Who is responsible for debts after the death of the debtor? As you know, not only the property of the deceased is inherited, but also his obligations to creditors. Therefore, in the event of the death of the debtor, claims are addressed to his heirs.

Under such circumstances, several scenarios are possible. Let's say the creditor learns about the death of a citizen a short time after this sad fact.

To recover a monetary debt from a deceased debtor, you must first notify the notary who will handle the inheritance case. You can quickly find out his coordinates at the notary chamber of the region where the deceased most recently lived.

After receiving all the data, it is advisable to address the notary with a notification of the debt. It can also be issued in the form of a claim addressed to an abstract circle of heirs.

Then the notary will notify all applicants for the property of the deceased about the existence of his unfulfilled obligations. If the death of the debtor became known after the inheritance was registered, then in any case a claim is filed to collect the debt from the heir. And here there are rules.

To what extent are the heirs liable for the obligations of the testator?

When it is necessary to collect a debt from the heir of the deceased, judicial practice and legislation indicate that the legal successors are liable for the obligations of the deceased in proportion to the size of the inherited property.

For example, if the debtor’s property is divided in half, then the burden of repaying the deceased’s debts is distributed to the same extent, regardless of their amount.

The heirs are liable for debts regardless of how they entered into their rights: by law or by will. In the latter case, the obligations of the deceased person are transferred to the part that falls on the share of each of the receivers.

The creditor should pay attention to the fact that claims for obligations can only be brought against those persons who accepted the inheritance in the prescribed manner.

If only one person has assumed his rights, then he will be fully responsible for the debts.

And also only an individual heir can pay off all obligations. After this, he will receive the right of recourse claims against the remaining owners of the deceased’s property.

Procedure for filing a claim

Before initiating legal proceedings, the creditor must:

- Contact a notary to submit a claim. If the demand is not submitted in a timely manner and the heir has assumed rights, he may refuse to pay if he did not know about the debt in advance.

- Contact the executor of the will or a notary to ensure the safety of the inherited property. Within 6 months, the heirs can sell the property of the deceased, which does not require state registration. It is in the lender's interest to retain it.

Algorithm of actions:

- Collection of documents;

- abandonment of the claim;

- sample statement of claim;

- determination of jurisdiction;

- payment of state duty;

- trial;

- obtaining a court decision.

Important! If heirs appear, the creditor has the right to change the defendant at any time.

Collection of documents

List of documentation to initiate the process:

- the applicant's civil passport;

- power of attorney on behalf of a legal entity (if the plaintiff is a legal entity);

- receipt of payment of state duty;

- loan agreement, receipt;

- a copy of the request to the notary and the response from him;

- information about the availability of property.

Note! Particular attention must be paid to preparing evidence. Often, courts refuse to satisfy claims if the plaintiff cannot prove that the deceased debtor has liquid property.

Filing a claim

The statement of claim must be made in writing. The document must comply with the rules of civil procedure.

Key points:

- name of the court;

- details of the applicant (full name of the plaintiff - an individual and place of registration, name of the legal entity and legal address);

- cost of claim;

- name of the statement of claim;

- data on the conclusion of a loan agreement or other document confirming the existence of an obligation;

- information about the death of the debtor;

- reference to law;

- a request to collect debt from inherited property;

- list of documents for the claim;

- date and signature.

Sample statement of claim

Sample claim against inherited property: alt: Statement of claim by the testator's creditor, submitted before the heirs accept the inheritance

Determination of jurisdiction

A claim against inherited property is filed at the last place of residence of the deceased debtor. Therefore, the creditor must apply to the court at the place where the inheritance was opened.

The application is submitted to the district or city court.

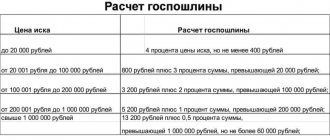

Payment of state duty

A claim against inherited property is a property claim.

Therefore, the state duty is calculated based on the requirements of Art. 333.19 Tax Code of the Russian Federation:

- if the debt is less than 20,000 rubles, you must pay 400 rubles;

- with a debt amount of 20,000 rubles. up to 100,000 rubles, you will need to pay 800 rubles. and another 3% of the amount over 20,000 rubles;

- with a debt amount of 100,001 rubles. up to 200,000 rubles, you must pay 3200 rubles. and an additional 2% of the debt amount over 100,000 rubles;

- with a debt amount of 200,001 rubles. up to 1,000,000 rubles, you will need to deposit 3,200 rubles. and another 1% of the amount exceeding 200,000 rubles;

- if the debt is more than 1,000,000 rubles, the fee will be 13,200 rubles. and an additional 0.5% of the amount that exceeded RUB 1,000,000.

The maximum duty amount is 60,000 rubles.

Trial

Popular issues in litigation are:

- The judge's request to identify the defendant. Since the estate is considered a fictitious defendant. But the plaintiff must substantiate his claim, since inherited property, like the property of a legal entity, does not have a real owner. It is simply separate property. Therefore, the applicant must justify his claim.

- The next problem is the ability of the heirs to sell the inherited property in advance and before taking ownership. As a result, the lender cannot get their money back. To avoid this, the plaintiff must apply to the court to impose a ban on the sale of objects.

- Another difficulty is the lack of information from the creditor about the composition of the deceased’s property. The secrecy of the will does not allow the notary, the executor of the will and other citizens to notify the creditor about the composition of the property.

In addition, in 2021 there is no uniform approach to identifying the property of the deceased. The notary requests information from Rosreestr, the State Traffic Safety Inspectorate, and Sberbank. But the property may include accounts in other banks, special equipment and other things that the notary may not know about. Therefore, the creditor must himself find and prove the existence of property of the deceased.

Required documents

The list may vary. It is necessary to prepare and submit documentation for a claim on property, following the principle of ownership, which includes:

- Justification of debt . Agreements, receipts, receipts and bank statements are provided here.

- Definition of property . It is expected to present papers issued by a notary at the place where the inheritance was disclosed, a copy of the will, etc.

- Identity cards . For individuals - passport. Legal entities act through a representative with sufficient grounds.

- Death certificate . Proves that the inheritance is indeed such, because the owner has passed away, which is officially confirmed.

After collecting the papers, it’s time to file a claim to defend the property in the form of a share of the inheritance to return the funds previously spent. It is important to determine jurisdiction, that is, to send the claim to the right authority.

Arbitrage practice

The court does not always satisfy the demands of creditors.

Often, the plaintiff goes to court without sufficient grounds for this. The resolution of the Plenum of the Supreme Court in 2012 establishes that the death of the debtor is not a basis for early execution of the contract. Thus, if the deceased borrower regularly made payments, and his heirs continue to fulfill their obligations, then the banking organization cannot oblige them to repay the debt immediately.

Only if there is a large delay and there are grounds for collecting the debt in full, the court will consider and satisfy the applicant’s demands.

The debt can be paid ahead of schedule at the initiative of the heir, upon notification of the creditor at least 30 days in advance and with the consent of the creditor.

When filing a claim against inherited property, it is necessary to take into account the fact that if there are several creditors, then the claims are satisfied in order of priority. The first person to file a claim receives the debt.

Important! If the amount of property is not enough to pay off all debts, it will not be possible to collect funds from the heirs.

What is

Despite the death of the debtor, his obligations to the creditor remain.

But it is impossible to get something from the deceased, and the creditor often does not know what to do next. On the one hand, he has the opportunity to demand the fulfillment of obligations from the heirs who have assumed their rights. But the notary cannot provide information about them, since this prohibited by law. As a result, the lender cannot identify them. The second option is to turn the claims to the executor of the will, but here, too, not everything is so simple. Establishing it, due to the secrecy of the will, is also impossible in most cases.

The third and final opportunity for a creditor to protect his right is to turn claims against the inherited property. In fact, claims against inherited property are quite rare and even professional lawyers cannot always cope with them.

Current legislature

The possibility of bringing a claim against inherited property is established in Art. 1175 of the Civil Code of the Russian Federation. It also stipulates that creditors can do this only before accepting the inheritance.

It is the norms of the Civil Code that can be relied upon when drawing up a claim. In this case, the given norms and rules in the Code of Civil Procedure should be taken into account.

Who is the defendant

In fact, deciding on the defendant is quite difficult. After all, the claim is brought against inherited property.

In fact, in this situation, the estate will play the role of the defendant. This is the same legal “fiction” as the concept of a legal entity.

However, in practice, quite often judges require the identification of the defendant. In this case, it makes sense to refer to the provisions of Art. 1175 of the Civil Code of the Russian Federation. Some indications of this possibility can be found in a number of resolutions of the Plenum of the RF Armed Forces.

It should be noted that even when the court accepts a claim against the defendant, the “hereditary property,” it is too early to calm down.

The case will be suspended until the heirs are identified. And they may well have time to “get rid” of the property and, as a result, recovery will be futile.

What is the jurisdiction

The legislation establishes that claims of creditors before the acceptance of the inheritance by the proper heirs must be filed at the place where the inheritance was opened.

A claim against inherited property will usually need to be filed at the debtor’s last place of residence.

Causes of conflicts between beneficiaries?

Dissatisfaction always concerns disagreement with the decision of the notary when distributing the inherited estate. Some get a share, others are left with nothing. There are often those who file a claim to cancel a will. Others wish to establish kinship. Others claim an obligatory share. Each case is individual, but most often a conflict of interest arises in the following situations:

- Having a will. Relatives who are left out of work try to cancel the document. And the legislation allows this to be done in court if it is proven that the testator was in an inadequate state, he was under pressure, threatened or blackmailed. The arguments are always different and depend on the circumstances of the case.

- The heir is declared unworthy. This status completely deprives the applicant of inheritance rights, regardless of the will of the deceased. Often this is the main reason for distributing the property of the deceased. Recognition presupposes a corresponding court decision. Cancellation of this status is also possible in court.

- Mandatory share. There is a category of applicants in whose favor the legislation alienates part of the inheritance. A statement of claim has to be filed when the notary has ignored the requirements and refused to issue a certificate of inheritance. Opponents who want to deprive the obligatory share also resort to court.

- Unobvious heirs. Not only relatives, persons specified in the will, and obligatory heirs have the right to inheritance. Those whom the notary did not take into account when distributing the inheritance should file a corresponding claim and prove the legality of the claims in court, for which evidence must be provided.

- Missing entry deadlines. Sometimes the problem is resolved peacefully. But this is possible if all participants in the inheritance matter agree to re-share the values remaining after the testator passes away. Otherwise, only a judge can order a new process, as a result of which the property will be divided taking into account the plaintiff's requirements.

A separate case is a conflict related to receiving a marital share. Former and current wives who were not taken into account when dividing the inheritance have the right to file a claim demanding to take away half of the jointly acquired property. But in order to understand the specifics of filing a claim and justifying the legitimacy of the claims, you need to understand how the property of the deceased is divided.

Nuances of the procedure

All cases of claims from the inheritance, property, and monetary savings of the deceased in judicial practice are different, although the general essence of the plaintiffs’ claims is similar. The reason is the lack of legal knowledge, which leads to fatal mistakes. If the name of the representative is not indicated, but the statement of claim is filed in the wrong instance, there will be no movement in the case of collecting property from the inheritance in favor of paying off debts. With regard to the plaintiff himself, the sample statements of claim show that this may be a creditor personally, a company representative, or a lawyer who acts on the basis of a notarized power of attorney.

Government duty

Claims of this type are classified as property claims.

The state duty is calculated on the basis of Article 333.19 of the Tax Code of the Russian Federation (subclause 1 of clause 1). It is directly related to the assessed value of the property. The property must be appraised by a licensed appraisal company. In a similar way, future property is assessed when submitting documents to obtain a certificate of inheritance.

| Cost of property (rubles) | State duty |

| >1 000 000,00 | RUR 13,200.00+0.5%. No more than 60 thousand. |

| 200 001,00 – 1 000 000,00 | RUB 5,200.00+1% |

| 100 001,00 – 200 000,00 | RUR 3,200.00+2% |

| 20 001,00 – 100 000,00 | RUR 800.00+3% |

| 20 000,00 | 4%. At least 400 rubles. |

The calculation is based on the amount exceeding the minimum limit.

Example: Property costs 250 thousand rubles. The fee is calculated from 50 thousand, that is, from the amount that exceeds the lower limit. In this case, you will have to pay 1% of 50 thousand + 5200 rubles = 5700 rubles.

Before starting to prepare a claim, we recommend that you contact us for a free consultation. We will provide all the basic information and explain the features of working with such documents. We are ready to take on the entire procedure of interaction with the notary and the court, as well as drawing up the application.

Lawyer's answers to questions about drawing up an application

Tell me, who can be an interested party, if there are no other heirs, when registering an inheritance for a land plot?

In your case, the interested party must indicate the local administration. The answer to this question is contained in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9 “On judicial practice in inheritance cases”: Based on paragraph 3 of Article 1151 of the Civil Code of the Russian Federation, as well as Article 4 of the Federal Law of November 26, 2001 N 147-FZ “On the entry into force of part three of the Civil Code of the Russian Federation” pending the adoption of the relevant law defining the procedure for inheritance and accounting of escheated property transferred by inheritance by law into the ownership of the Russian Federation, as well as the procedure for transferring it into the ownership of constituent entities of the Russian Federation or into the ownership of municipal entities, when courts consider inheritance cases on behalf of the Russian Federation, the Federal Agency for State Property Management (Rosimushchestvo) represented by its territorial bodies acts in the manner and within the limits determined by federal laws, acts of the President of the Russian Federation and the Government of the Russian Federation , the powers of the owner of federal property, as well as the function of accepting and managing escheated property; on behalf of the federal cities of Moscow and St. Petersburg and municipalities - their respective bodies within the competence established by the acts defining the status of these bodies.

USEFUL INFORMATION: Confirmation of kinship for inheritance in a standard and judicial manner

I need to register land rights after my father's death. None of the heirs lay claim to it. Within 6 months from the moment the inheritance was opened, I did not do this, so we actually lived on it and the question of registration did not arise. How should I file an application to the court?

If everything is in order with the documents for the land, there is no dispute between the heirs about the division of the plot, and you have actually accepted the inheritance, you need to fill out an application for acceptance of the inheritance using this sample.

How to correctly write a statement of claim for acceptance of an inheritance?