Submitting a writ of execution to the bank sometimes saves time for the claimant. After the court's decision, the plaintiff is issued a writ of execution. After this, you can write an application to the bank based on the writ of execution, rather than apply for the initiation of enforcement proceedings.

ATTENTION: our lawyer for enforcement proceedings will help the claimant receive the awarded amount by court decision, and will tell the debtor where to turn if collectors or bailiffs threaten.

Which bank should I submit the writ of execution to?

The application to the bank under the writ of execution must go to the bank where the debtor has a current account. The court decision has special force and its implementation is monitored by bailiffs, but their work is not always carried out as quickly as we would like, and we have to appeal the inaction of the bailiff. The most effective way to do this is to submit a writ of execution to the bank. Naturally, you need to choose the bank where the debtor has an account.

If you do not know the account number, you can always contact the tax authority for information about the debtor’s open accounts (this information is provided upon presentation of a writ of execution for collection). It is enough to find out whether the debtor belongs to a specific tax office at the state registration address. The tax service is not obliged to provide this kind of information to third parties. Therefore, it will be necessary to show a documented court decision to confirm the future presentation of the writ of execution to the debtor’s bank.

Before using this opportunity, you need to take into account that this method only works for legal entities and private entrepreneurs. The latter are required to report all data on open and closed accounts to the tax office. Any violation immediately results in a fine.

If the debtor has open accounts, then the money from there will simply return to you. If they are missing or completely empty, then you will need to look for hidden sources of income, foreclose on the debtor’s mortgaged property and unofficial savings.

Who can send feedback to IL

Today, bailiffs are vested with expanded powers, however, due to high workload, production execution has also become larger. Loan obligations, non-fulfillment of court decisions, and inaction of FSSP inspectors are becoming commonplace.

The collecting party should remember that writs of execution must be presented at the address of execution. Thus, not only bailiffs are given the right to serve IL and work on enforcement proceedings. Documentation is issued to the party that wins the lawsuit in order to forcibly collect the debt.

It is noteworthy that IL can be sent for execution to the FSSP bailiff by the court, or issued directly to the claimant. In turn, he has the right to initiate proceedings based on writs of execution, terminate proceedings or submit an application to revoke the writ of execution. Accordingly, with any decision, both the debtor and the claimant are endowed with certain obligations and rights.

Further, in the article, information will be provided on the types of return applications and how IL is recalled. You can also download the application form on this page.

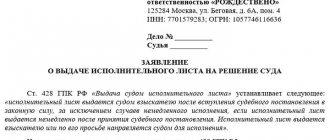

Application to the bank for presentation of a writ of execution

Submitting an application to the bank to present a writ of execution is one of the most effective ways to receive funds as quickly as possible. You will save your time if you immediately collect the necessary package of documents.

When contacting the bank in person, you need to have with you:

- two copies of the application (one is sent to the bank, the second remains with you - a bank employee will put a stamp on it, recording the fact and day of submission of the application)

- writ of execution in original

- a copy of the judicial act on the basis of which the writ of execution was issued

- a copy of the passport (first spread and page with registration).

If an attorney is applying on your behalf, he must have a power of attorney and a copy of it, as well as a copy of his passport. A copy of the power of attorney is attached to the application, the original is presented to the bank employee for review.

If the consideration of the case was not limited to the first instance, then all available judicial acts in your case should be attached to the application. You can obtain them in the court of first instance by submitting an application. Having received duly certified judicial acts, attach them to your application to the bank.

After receiving the application, the bank is obliged to immediately comply with the requirements of the writ of execution. No later than three days from the date of presentation of the documents, funds must be debited from the account of the debtor organization.

USEFUL: video with tips on protecting the rights of the claimant, the possibilities of filing a complaint against the bailiff, actions aimed at speedy execution of the court decision by the bailiff:

Grounds for revocation

As a rule, revocation of a writ of execution is possible in some situations. The illustrative examples from life given in the table below will help you understand this matter.

| № | Legal grounds for revocation | Explanations |

| 1 | The debt collector was informed where the debtor's money was kept | So, the debtor submitted an application to participate in the procurement. At the same time, he provided the customer with a guarantee from the bank. However, if there is no money in the bank account, the bank will not give such a guarantee. |

| 2 | The participants in the arbitration process (plaintiff-collector and defendant) came to a settlement agreement | In the text of the settlement agreement, the parties have the right to indicate a separate clause stating that an application for revocation will be required. After all, after a settlement agreement is drawn up in arbitration, the executive document still remains in force. If the debtor violates the terms of the settlement agreement, the claimant has the right to once again apply to the FSSP to collect the debt. This can be done within 3 years. |

| 3 | The court initiated bankruptcy proceedings on its own initiative | In this case, the claimant must include claims for monetary obligations in the register of creditors' claims. Such data is taken from the executive document. As a result, it needs to be recalled |

| 4 | When the deadline for filing an appeal is restored | If the appeal period is restored, the court decision is not considered to have entered into force. As a result, a duplicate of a writ of execution drawn up before the entry into force of a court decision, with the exception of cases of immediate execution, is considered void and is subject to revocation by the court that issued such a judicial act (Article 428 of the Civil Procedure Code of the Russian Federation, 319 of the Arbitration Procedure Code of the Russian Federation) |

Also, revocation of an executive document is possible:

- Upon cancellation (partial cancellation) or after changing the court decision on the debtor (clause 17.29 of the Instruction of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 100 of December 25, 2013).

- In case of a change in the amount of alimony payments for children and other family members (clause 60 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 56 of December 26, 2017).

- After the execution of a court decision on the debtor, if such a judicial act is not subject to enforcement (Determination of the Supreme Court of the Russian Federation No. 309-ES19-26330 of January 30, 2021).

Site Expert

Ekaterina Zakharova

Work experience as a lawyer - 15 years. Since 2021, he has been an expert of the Commissioner for the Protection of the Rights of Entrepreneurs. Specializes in the field of procedural, civil, financial, family and labor law.

Ask a Question

If, during the bankruptcy of a debtor, bankruptcy proceedings are opened against him, the bank has the right to return the writ of execution independently. Indeed, at this stage of bankruptcy, the execution of such a document is suspended (Article 126 of the Law of the Russian Federation No. 229-FZ). In this case, the bank is obliged to notify the creditor of changes in significant circumstances in the debtor’s case.

How to submit a writ of execution to several banks?

There may be a situation where the debtor has several current accounts opened with different credit institutions. For example, each of them separately does not have enough funds to fulfill the claims of the creditor, and if money is written off from several accounts at once, the court decision will be executed.

Under such circumstances, two options are possible:

- presentation of the writ of execution to the bailiff service. The bailiff will decide from which accounts and in what amount to write off funds to pay off claims;

- present the sheet to the credit institution, and after partial fulfillment of the requirements contained in the sheet, revoke the writ of execution and present it to another credit institution.

It is impossible to submit documents to several banks at the same time, since the original writ of execution is issued by the court in one copy, and copies, even if they are notarized, are not accepted by the bank.

Additional copies or copies of the writ of execution due to the presence of different current accounts with the debtor are not issued by the court. Thus, the only possible and most rational option is to present the writ of execution to the credit institution, wait for partial fulfillment of the requirements, and then revoke the writ of execution and present it to another bank.

Procedure for consideration

The procedure for considering a request for revocation directly depends on where the writ of execution is withdrawn from. So, after such a petition is accepted by the FSSP, the bailiff will issue a resolution to close the proceedings. Moreover, the revoked sheet must be issued to the claimant:

- in person;

- by sending a registered letter with notification by mail.

As for the bank, in accordance with clause 3.2 of the Directive of the Central Bank of the Russian Federation N 5037-U dated December 25, 2021, the return of the writ of execution is carried out by the credit institution on the business day following the date the bank accepted the request for revocation. Moreover, such returns are made only against receipt.

In this case, on the reverse side of the executive document the following is indicated:

- legal basis for return;

- date of revocation;

- the amount of debt collected (in case of partial payment of the debt).

All entries on the back of the writ of execution must be certified by the seal of the credit institution and the personal signature of a bank employee.

How to revoke a writ of execution from a bank?

If for some reason you made a mistake and presented the sheet to the wrong credit institution where the debtor has an account, or the funds in the debtor’s account with this bank turned out to be insufficient, but there are accounts in other banks, then you have the opportunity to revoke document.

Firstly, this right is enshrined in the Federal Law “On Enforcement Proceedings”, and is also regulated by the Regulations of the Bank of Russia on the procedure for the acceptance and execution by credit institutions of enforcement documents presented by creditors.

In order to receive previously submitted documents, you must submit an application. The application form is free. Some content requirements are established by law. The application should indicate:

- name of the debtor organization;

- name of the organization - the claimant, or surname and initials;

- series and number of the executive document;

- the name of the body that made the decision in connection with which the writ of execution was issued.

The writ of execution must be returned to you immediately. The law provides the credit institution with one business day to return the document.

The revocation procedure is also possible if partial payment of the writ of execution has already been made. On the reverse side, the bank will make an appropriate note indicating the reason for the return, as well as information about partial fulfillment, if any. The revocation of a writ of execution does not prevent its re-submission either to another credit institution or to the bailiff service.

Analytics Publications

At first glance, fulfilling the requirements of an executive document is a routine operation that should not cause serious controversy: the execution procedure, including the liability of banks for illegal actions, is regulated by law. However, judicial practice shows that not everything is so simple.

In accordance with the provisions of the Law on Banks[1], the Law on Enforcement Proceedings[2], Bank of Russia Regulations No. 285-P and No. 383-P, credit institutions are obliged to immediately fulfill the requirements for the collection of monetary funds contained in executive documents or decisions of bailiffs. funds. In accordance with the position of the Central Bank of the Russian Federation[3], immediately means no later than the business day following the receipt of such documents.

In accordance with Article 8 of the Law on Enforcement Proceedings, a writ of execution on the collection of funds or their arrest may be sent to a bank or other credit organization directly by the recoverer. The legislator listed the specific requirements for the claimant's application. Thus, the application must contain:

- bank account details of the claimant for the transfer;

- Full name, citizenship, details of an identity document, place of residence or place of stay, TIN or details of a migration card and a document confirming the right to stay (residence) in the Russian Federation of the claimant-citizen;

- name, TIN or code of the foreign organization, state registration number, place of state registration and legal address of the claimant - a legal entity.

When does the bank have the right to delay execution?

A credit institution may fail to execute a writ of execution in the following cases:

- when there are no funds in the debtor’s accounts;

- when funds in these accounts are seized;

- in other cases provided for by federal law[4].

In accordance with Part 6 of Article 70 of the Law on Enforcement Proceedings, a credit institution has the right to delay the execution of a writ of execution to verify its authenticity or the reliability of information in case of reasonable doubt, but for no more than seven days. In this case, transactions with funds in the debtor's accounts are immediately suspended within the limits of the amount of funds subject to collection. It is important to understand that the courts, when assessing the legality of the suspension of execution, require confirmation of the validity of doubts about the reliability of the information. Otherwise, there is a high risk of awarding damages in favor of the claimant if the actions or inaction of the organization led to the real impossibility of executing the judicial act.

The courts came to this conclusion, for example, in case No. A40-69191/2017[5]. The claimant sent a writ of execution to the bank along with a statement that complied with the requirements of the law. The bank suspended the execution of the document transferred to it, citing the provisions of the law and recommendations of the Bank of Russia. After the check, the credit institution notified the creditor that there were insufficient funds in the debtor's account.

When considering the case, it turned out that at the time of presentation of the writ of execution, there were sufficient funds in the account. The bank tried to substantiate its doubts about the authenticity of the writ of execution: it pointed out that the website of the file of arbitration cases lacked information about the entry into force of the decision, as well as information about the series and number of the writ of execution.

The courts, satisfying the plaintiff’s demands, came to the conclusion that the bank’s actions were unlawful, since:

- the decision on the case posted on the Internet is identical to the presented writ of execution;

- the original writ of execution was prepared taking into account the instructions for office work in the arbitration courts of the Russian Federation, and contains information about the entry into force of the judicial act;

- The case materials do not contain evidence of the defendant's appeal to the arbitration court, which issued a writ of execution with requests for information of any nature.

At the same time, the bank did not provide evidence of verification of the authenticity of the writ of execution.

What are the consequences?

If the bank's actions are found to be unlawful, the financial losses for the violator can be significant. In accordance with Part 2 of Article 17.14 of the Code of Administrative Offenses of the Russian Federation, the fine depends on the amount of money to be collected and can reach one million rubles. Also, the Arbitration Procedural Code of the Russian Federation provides for the possibility of imposing a judicial fine on an organization in the event of its unlawful actions. In this case, the fine can reach one hundred thousand rubles. An additional negative consequence in the form of financial losses for a credit institution that has unlawfully failed to execute a writ of execution is the possibility of recovery of losses from the claimant under the document.

An analysis of the above legal norms shows that banks are obliged to immediately execute enforcement documents received by them and are significantly limited in the choice of grounds for refusing to execute the presented document. At the same time, there is a high risk of recovery of losses from the client in the event of unlawful debiting of funds.

For example, in one of the cases[6], the Arbitration Court of the Moscow District recognized the client’s claim against the bank to recover damages in the form of real damage for writing off funds under a forged writ of execution.

During the consideration of the case, it was established that the bank executed a fake writ of execution, limiting itself to a formal check based on external visual signs and the completeness of the details established by the Law on Enforcement Proceedings. The court pointed out that in this situation the bank is a subject of professional entrepreneurial activity in the field of conducting operations on customer accounts, carrying them out with a certain degree of risk. Accordingly, the bank must bear responsibility in the form of compensation for losses caused by the incorrect write-off of funds belonging to the plaintiff.

The courts of three instances concluded that the actions taken by the bank were not sufficient to establish the authenticity of the disputed executive document.

In another similar case, the courts came to the conclusion that the failure of the bank to carry out verification activities regarding the issuance of a writ of execution and the validity of its presentation for execution, as well as the failure to take additional protective measures (SMS notification, request through the bank-client system) is unlawful behavior of the defendant in the form inaction[7].

What to consider when checking a writ of execution?

The most common grounds for bank refusal are errors made in the application or writ of execution submitted by the claimant. Since the law contains strictly defined requirements, the bank is obliged to check whether the application or document meets such requirements.

For example, in case No. 40-75776/2014[8], the courts refused to recognize the bank’s actions to return the writ of execution without execution as illegal.

From the circumstances of the case it follows that the organization applied to the bank with an application for execution of the writ of execution. A power of attorney for the representative was attached to the application. The bank returned the writ of execution and attached documents to the applicant without execution, indicating that:

- the power of attorney for the representative was signed by a person who is not listed as the sole executive body on the official website of the Federal Tax Service;

- documents confirming the authority of the signatory are not attached to the application, are not confirmed by the company and the data of the unified state register of legal entities.

The courts came to the conclusion that the bank’s actions were lawful, since the law requires[9] to provide information about the creditor and representative, which was not done. However, requests by credit institutions for additional documents and information that are not provided for by law are regarded by the courts as unlawful actions[10].

Also, the courts recognize as lawful the actions of a credit institution to return a writ of execution if the writ of execution contains errors and typos in the TIN or the name of the parties to the dispute.

In one of the cases, the court indicated that the writ of execution was lawfully returned to the claimant due to the incorrect indication of the TIN and name of the debtor[11]. In case No. A56-70250/2015, the courts came to the conclusion that the refusal to accept the writ of execution was legal due to the presence of different spellings of the name of the claimant in the writ of execution, and the differences were in one letter. The courts rejected the claimant's arguments that the bank was obliged to conduct an inspection in order to clarify the information contained in the writ of execution[12].

At the same time, there is other judicial practice, according to the meaning of which the formal approach of credit institutions to verifying an application and an executive document is unacceptable.

Thus, the courts, satisfying the applicant’s demands to recognize the bank’s actions as illegal, pointed out that writing the name of the debtor - a state institution in an abbreviated form is not a basis for returning the writ of execution, since the abbreviated name is well known, which excludes an error in identifying the debtor, even taking into account incorrect indication of the debtor's TIN. Also, the courts did not agree with the bank’s arguments that the lack of information about the OGRN and the place of registration of the creditor prevents execution, since the required information was indicated in the application, as well as on the seal imprint[13].

Another basis for a credit institution’s lawful refusal to accept a writ of execution is the indication in the application of the details of the representative’s account as the account to which funds are to be transferred. In accordance with paragraph 1 of part 2 of Article 8 of the Law on Enforcement Proceedings, only the bank account details of the claimant can be indicated in the application.

In the overwhelming majority of cases, judicial practice is based on a literal interpretation of this norm[14]. The courts come to the conclusion that from the systematic interpretation of the provisions of the Law on Enforcement Proceedings, it follows that the transfer of collected funds is made only to the account of the claimant, therefore, credit organizations rightfully refuse to transfer funds to the account of representatives.

However, here too there is a different judicial practice. For example, in case No. A40-87058/2010, the cassation court came to the opposite conclusion, indicating that the provisions of the Law on Enforcement Proceedings do not limit the right of the claimant to send funds only to his own account, and not to the account of another person, if there is an application, which contains the details of the attorney's account, and a power of attorney with the provided powers to receive the awarded funds[15].

How to reduce the risk?

An analysis of judicial practice shows that in disputes about the execution of executive documents by credit institutions, the degree of judicial discretion is high; even in the same arbitration judicial district, contradictory judicial acts can be issued under similar circumstances.

Taking into account the emerging practice, officials of credit institutions should not approach the verification of the authenticity of claims formally. To reduce risks, not only a visual check of the writ of execution is necessary. You should also try to establish its authenticity based on information obtained at least from publicly available sources, for example, from the official websites of courts, the Federal Tax Service and other government bodies.

It also seems advisable, in the event of suspension of execution, to record all actions to verify the accuracy of the submitted documents for the purpose of protecting the interests of the organization in potential disputes. The listed measures will reduce potential risks and reduce negative consequences.

[1] Article 27 of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities.”

[2] Article 70 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

[3] Letter of the Bank of Russia dated March 27, 2013 No. 52-T “On ensuring the immediate execution of demands for the collection of funds.”

[4] Part 8 of Article 70 of the Law on Enforcement Proceedings.

[5] Resolution of the Arbitration Court of the Moscow District dated July 18, 2018 in case No. A40-69191/2017.

[6] Resolution of the Arbitration Court of the Moscow District dated April 12, 2018 in case No. A40-71636/2017.

[7] Resolution of the Moscow District Arbitration Court dated September 8, 2015 in case No. A40-160913/2014.

[8] Resolution of the Moscow District Arbitration Court dated January 29, 2015 in case No. A40-75776/2014.

[9] Part 3 of Article 8 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

[10] See, for example, the resolution of the Arbitration Court of the Volga-Vyatka District dated 08/11/2015 in case No. A38-2333/2014, the resolution of the Federal Arbitration Court of the Volga District dated 09/30/2013 in case No. A06-8016/2011.

[11] Resolution of the Federal Arbitration Court of the Moscow District dated April 28, 2014 in case No. A40-59286/2013.

[12] Resolution of the Arbitration Court of the North-Western District dated October 17, 2016 in case No. A56-70250/2015.

[13] Resolution of the Arbitration Court of the Moscow District dated September 16, 2014 in case No. A40-59267/2013.

[14] See, for example, the resolution of the Arbitration Court of the Volga District dated 06/03/2015 in case No. A12-29370/2014, the resolution of the Federal Arbitration Court of the West Siberian District dated 04/11/2014 in case No. A45-11127/2013.

[15] Resolution of the Federal Arbitration Court of the Moscow District dated July 4, 2011 in case No. A40-87058/2010.

Lawyer for enforcement proceedings in Yekaterinburg

Requirements for filing a writ of execution:

- Availability of account details where you are going to receive money;

- Full passport data for individuals. For enterprises and legal entities, complete details must be provided;

- A power of attorney, if the debt is not officially registered in your name and your initials are not on the writ of execution.

Only by following our recommendations can you submit a writ of execution to the bank or contact us for legal assistance to support your interests in a credit institution or within the framework of enforcement proceedings.

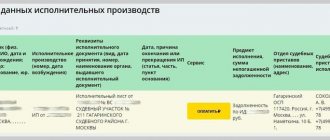

Search for banks servicing the debtor's accounts

To obtain information about the banks in which accounts are opened, you must send a request to the Federal Tax Service, providing a copy of the writ of execution. The response must be received by the applicant no later than 7 days from the date of delivery of the application (Part 8 of Article 69 of Federal Law No. 229).

The response from the Federal Tax Service indicates:

- open accounts;

- names of the banks that serve them.

Information about the condition and status of each account can be obtained by contacting the bank with a writ of execution.

Time limits for execution of a court decision

Within 3 days, the bank is obliged to write off and transfer funds in accordance with the instructions specified in the document.

However, if a credit institution receives several demands for collection from one account, then they will be executed in the manner established by Art. 855 of the Civil Code of the Russian Federation. Namely:

- Repayment of debt associated with damage to the life and health of the applicant.

- Tax and salary arrears.

- Other private debts.

At the same time, private debts are collected as they are received. Those who submitted an application earlier will receive the amount due faster.

The date of debiting the funds is indicated on the writ of execution. The document itself is sent to the organization that issued it. If there are insufficient funds in the account, the sheet is returned to the applicant indicating the amount withheld.